| ☐ | ||

| ||

| ||

| ||

| Preliminary Proxy Statement | |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under §240.14a-12 |

|

☒ | No fee required. | |||

☐ | ||||

| Fee paid previously with preliminary materials. | |||

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and | |||

0-11. | ||||

Air Lease Corporation

2000 Avenue of the Stars, Suite 1000N

Los Angeles, California 90067

(310) 553-0555

March 28, 201818, 2024

Dear Fellow Stockholder:

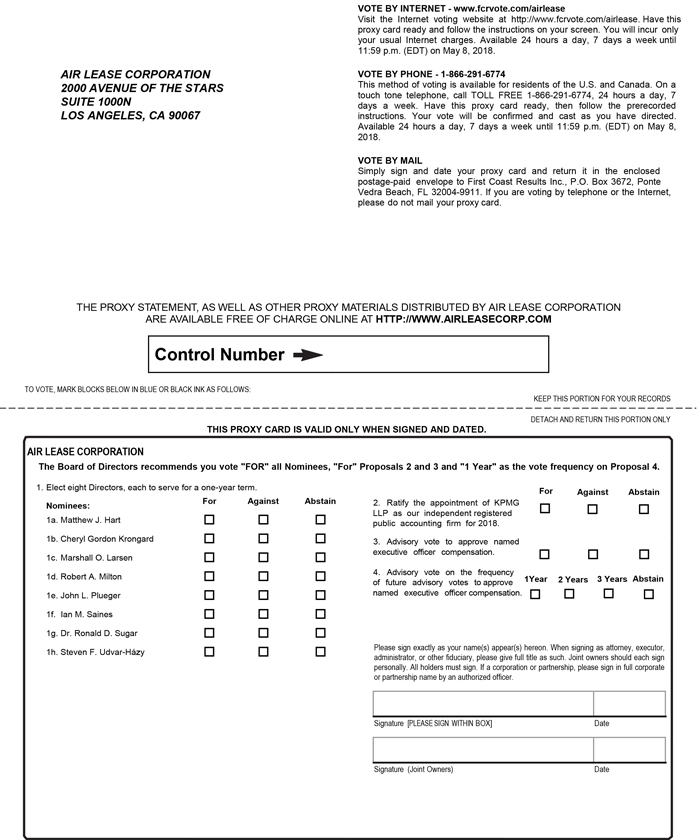

Your officers and directors join me in inviting you to attend the 20182024 Annual Meeting of Stockholders (the “Annual Meeting”) at 7:8:30 a.m., Pacific Time,time, on Wednesday,Friday, May 9, 2018,3, 2024. The Annual Meeting will be held online in a virtual only meeting format via a live audio webcast at Century Plaza Towers, 2029 Century Park East, Concourse Level, Conference Room A, Los Angeles, California 90067.www.cesonlineservices.com/al24_vm. There will not be a physical location for the Annual Meeting. Stockholders may only participate online and must pre-register to attend.

If you plan to attend the virtual meeting, you will need to pre-register at www.cesonlineservices.com/al24_vm by 8:30 a.m. Pacific time on Thursday, May 2, 2024. To pre-register for the Annual Meeting, please follow the instructions provided under “Other Matters – General Information About the Annual Meeting – How do I pre-register to attend the Annual Meeting?” found in the accompanying Proxy Statement. Once registered, you will be able to attend the Annual Meeting, vote and submit your questions during the Annual Meeting via live online webcast by visiting www.cesonlineservices.com/al24_vm.

The expected items of business for the meetingAnnual Meeting are described in detail in the attached Notice of 20182024 Annual Meeting of Stockholders and Proxy Statement.

We look forward to seeing youyour participation on May 9th.3rd. We encourage you to submit your vote as soon as possible, whether or not you expect to attend the Annual Meeting. Your vote is very important to us.

Sincerely,

Steven F.Udvar-Házy

Executive Chairman of the Board

Notice of

|

| Time and Date: | ||||

| Location: | ||||

| Agenda: | (1) | Elect | ||

| (2) | Ratify the appointment of KPMG LLP as our independent registered public accounting firm for | |||

| (3) | Advisory vote to approve named executive officer compensation; | |||

| (4) | Advisory vote on the frequency of future advisory votes to approve named executive officer compensation; and | |||

| (5) | Act upon such other matters as may properly come before the meeting or any postponement or adjournment. | |||

| Record Date: | You can vote at the meeting and at any postponement or adjournment of the meeting if you were a stockholder of record as of the close of business on March | |||

| Voting: | Please vote as soon as possible, even if you plan to attend the meeting, to ensure that your shares will be represented. You do not need to attend the meeting to vote if you vote your shares before the meeting. If you are a record holder, you may vote your shares by mail, telephone or the Internet. If your shares are held by a broker, bank or other nominee, you must follow the instructions | |||

| Annual Report: | Copies of our | |||

Important Notice Regarding the Availability of Proxy Materials for the 2024 Annual Meeting

of Stockholders to be Held on May 9, 2018:3, 2024: Our Proxy Statement and Annual Report are available online at http://www.proxyvote.com.

By Order of the Board of Directors,

Carol H. Forsyte

Executive Vice President, General Counsel, Corporate

Secretary and Chief Compliance Officer

Los Angeles, California

March 28, 201818, 2024

|

| Page | ||||

| ||||

| 90 | ||||

| 90 | ||||

Stockholder Proposals and Director Nominations for our | ||||

Householding of Proxy Materials

| 99 | |||

| ||||

Appendix A – Definitions and Reconciliations of Non-GAAP Financial Measures

| A-1 | |||

FORWARD-LOOKING STATEMENTS

Statements in this proxy statement that are not historical facts are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements are based on our current intent, belief and expectations. We claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 for all forward-looking statements. Words such as “can,” “could,” “may,” “predicts,” “potential,” “will,” “projects,” “continuing,” “ongoing,” “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates” and “should,” and variations of these words and similar expressions, are used in many cases to identify these forward-looking statements. Accordingly, these statements are only predictions and involve estimates, known and unknown risks, assumptions and uncertainties that could cause actual results, performance or achievements, or industry results to differ materially from those expressed in such statements. Our actual results, performance or achievements, or industry results could differ materially from those anticipated in such forward-looking statements as a result of the following factors, among others: our inability to obtain additional capital on favorable terms, or at all, to acquire aircraft, service our debt obligations and refinance maturing debt obligations; increases in our cost of borrowing, decreases in our credit ratings, or changes in interest rates; our inability to generate sufficient returns on our aircraft investments through strategic acquisition and profitable leasing; our failure to close our aircraft acquisition commitments; the failure of an aircraft or engine manufacturer to meet its contractual obligations to us, including or as a result of manufacturing flaws and technical or other difficulties with aircraft or engines before or after delivery; our ability to recover losses related to aircraft detained in Russia, including through insurance claims and related litigation; obsolescence of, or changes in overall demand for, our aircraft; changes in the value of, and lease rates for, our aircraft, including as a result of aircraft oversupply, manufacturer production levels, our lessees’ failure to maintain our aircraft, inflation, and other factors outside of our control; impaired financial condition and liquidity of our lessees, including due to lessee defaults and reorganizations, bankruptcies or similar proceedings; increased competition from other aircraft lessors; the failure by our lessees to adequately insure our aircraft or fulfill their contractual indemnity obligations to us or the failure of such insurers to fulfill their contractual obligations; increased tariffs and other restrictions on trade; changes in the regulatory environment, including changes in tax laws and environmental regulations; other events affecting our business or the business of our lessees and aircraft manufacturers or their suppliers that are beyond our or their control, such as the threat or realization of epidemic diseases, natural disasters, terrorist attacks, war or armed hostilities between countries or non-state actors; and any additional factors discussed under “Part I — Item 1A. Risk Factors,” in our Annual Report on Form 10-K for the year ended December 31, 2023 and other filings we make with the SEC, including future SEC filings.

All forward-looking statements are necessarily only estimates of future results, and there can be no assurance that actual results will not differ materially from our expectations. You are therefore cautioned not to place undue reliance on such statements. Any forward-looking statements are qualified in their entirety by reference to the risk factors discussed throughout the documents incorporated by reference in this proxy statement. Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update any forward-looking statement to reflect actual results or events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events.

|

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement and our Annual Report onForm 10-K before voting. We anticipate that these materials will first be made available to stockholders on or about March 30, 2018.21, 2024.

References throughout this Proxy Statement to “Air Lease Corporation,” “we,” “us,” and “our” refer to Air Lease Corporation and its subsidiaries, unless the context indicates otherwise.

Proposals to be Voted On

| Proposal | Board Recommendation | More Information

| ||||||

Proposal | Election of | FOR each nominee |

pages 18 to 27 | |||||

Matthew J. Hart

Cheryl Gordon Krongard Marshall O. Larsen

| Robert A. Milton John L. Plueger Ian M. Saines

Steven F. Udvar-Házy | |||||||

Proposal | Ratification of Appointment of Independent Registered Public Accounting Firm

| FOR |

page 28 | |||||

Proposal | Advisory Vote to Approve Named Executive Officer Compensation

| FOR |

page 29 | |||||

Proposal | Advisory Vote on the Frequency of Future Advisory Votes to Approve Named Executive Officer Compensation

|

1 YEAR |

page 30 | |||||

20182024 Proxy Statement | Air Lease Corporation | i

20172023 Financial Highlights

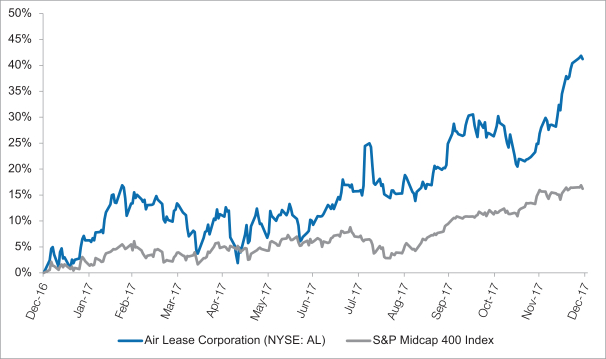

Air Lease Corporation experienced another successful year in 2017. Revenues increased 6.9% to $1.5 billion compared to 2016, supported by solid balance sheet growth with assets totaling $15.6 billion as of December 31, 2017.Pre-tax profit margin has expanded over the last five years, increasing from 34.2% in 2013 to 40.2% in 2017. Over the same period, ourpre-tax return on equity increased from 12.1% to 16.2%.

| ||

|

| |

|

| |

|

| |

|

|

2017and Business Highlights

In 2017, we successfully executed ourWe delivered strong financial and operational strategy which is designed to drive long-term stockholder value.results in 2023. Highlights for the year ended December 31, 2023 include:

(1) As of December 31, 2023, our owned fleet count included 14 aircraft classified as flight equipment held for sale and 12 aircraft classified as net investments in sales-type leases which were included in “other assets” on our consolidated balance sheet in our Annual Report on Form 10-K for 2023. |

(2) Lease utilization rate is calculated based on the number of days each aircraft was subject to a lease or letter of intent during the period, weighted by the net book value of the aircraft. |

(3) Consists of $16.4 billion in contracted minimum rental payments on the aircraft in our existing fleet and $14.6 billion in minimum future rental payments related to aircraft which will deliver between 2024 through 2027. |

Aircraft Activity.Activity. During the year ended December 31, 2017,2023, we purchased and took delivery of 3071 aircraft from our new order pipeline purchased 10 incrementaland sold 27 aircraft sold 31 aircraft and received insurance proceeds relating to the insured losses of two aircraft,1, ending the year with a total of 244463 aircraft in our owned aircraft with a net book value of $13.3 billion.fleet. The weighted average lease term remaining on our operating lease portfolio was 6.8 years and the weighted average age of our fleet was 3.84.6 years, and the weighted average lease term remaining was 7.0 years as of December 31, 2017. Our fleet grew by 10.3% based on2023. The net book value of $13.3our fleet grew by 6.9%, to $26.2 billion as of December 31, 20172023, compared to $12.0$24.5 billion as of December 31, 2016. In addition,2022, and our lease utilization rate for 2023 was 99.9%. Our managed fleet increased to 50was comprised of 78 aircraft as of December 31, 2017 from 302023, as compared to 85 aircraft as of December 31, 2016. We have a globally diversified customer base comprised of 91 airlines in 55 countries. As of February 22, 2018, all of our aircraft in our operating lease portfolio were subject to lease agreements.2022.

| 1 | Aircraft sales include two sales-type lease transactions during the year ended December 31, 2023. |

ii | Air Lease Corporation | 20182024 Proxy Statement

New OrderAircraft Pipeline.During 2017, we increased our total commitments with Airbus and Boeing by a net 35 aircraft. As of December 31, 2017,2023, we had commitments to purchase 368334 aircraft from Airbus and Boeing for delivery through 2023,2028 with an estimated aggregate commitment of $27.0$21.7 billion. We have placed 100% of our committed orderbook on long-term leases for aircraft delivering through the end of 2025 and have placed 65% of our entire orderbook. We ended 20172023 with $23.4$31.0 billion in committed minimum future rental payments, and placed 79%consisting of our order book on long-term leases for aircraft delivering through 2020. This includes $10.1$16.4 billion in contracted minimum rental payments on the aircraft in our existing fleet and $13.3$14.6 billion in minimum future rental payments related to aircraft which will deliver between 20182024 through 2027.

Financing. During 2023, we raised approximately $3.6 billion in committed debt financings, with floating interest rates ranging from SOFR plus 0.42% and 2022.

Financing. In 2017,SOFR plus 1.50% and fixed interest rates ranging from 5.30% to 5.94%, net of the effects of cross-currency hedging arrangements. Additionally, we issued $2.2 billion senior unsecured notesended 2023 with an average interest rate of 3.16%, with maturities ranging from 2022 to 2027. In 2017, we increasedaggregate borrowing capacity under our unsecured revolving credit facility capacity to approximately $3.8of $6.3 billion representing an 18.6% increase from 2016 and extended the final maturity to May 5, 2021. We ended 2017 withtotal liquidity of $6.8 billion. As of December 31, 2023, we had total debt outstanding net of discounts and issuance costs, of $9.7$19.4 billion, of which 85.4%84.7% was at a fixed rate and 94.6%98.4% of which was unsecured. Ourunsecured and, in the aggregate, our composite cost of funds decreased to 3.20% as of December 31, 2017 from 3.42% as of December 31, 2016.was 3.77%.

Tax reform. On December 22, 2017, the U.S. Tax Cuts and Jobs Act (the “Tax Reform Act”) was signed into law. The Tax Reform Act significantly revised the U.S. corporate income tax law by, among other things, lowering the U.S. corporate tax rate from 35% to 21% effective January 1, 2018. As a result of the Tax Reform Act, we recorded an estimated tax benefit of $354.1 million or $3.16 per diluted share due to there-measurement of deferred tax assets and liabilities for the quarter ended December 31, 2017.

Financial Highlights. In 2017, Our total revenues increased by 6.9% to $1.5 billion, compared to 2016. The increase in our total revenues is primarily due to the $1.2 billion increase in the net book value of our operating lease portfolio. Our net income for the year ended December 31, 20172023 increased by 15.9% to $2.7 billion as compared to 2022. The increase in total revenues was $756.2primarily driven by the continued growth in our fleet, an increase in sales activity, and higher end of lease revenue. Our net income attributable to common stockholders for the year ended December 31, 2023 was $572.9 million, or $6.82$5.14 per diluted share, as compared to $374.9a net loss attributable to common stockholders of $138.7 million, or $3.44$1.24 loss per diluted share, for the year ended December 31, 2016.2022. The increase compared to the prior year was primarily due to the increase in revenues from the continued growth of our fleet, an increase in sales activity, and higher end of lease revenue described above, partially offset by higher interest expense, which resulted from an increase in our composite cost of funds. In addition, in 2023, we recognized a net benefit of approximately $67.0 million from the settlement of insurance claims under JSC Siberia Airline’s (“S7”, a Russian airline) insurance policies related to four aircraft previously included in our owned fleet and our equity interest in certain aircraft from our managed fleet that were previously on lease to S7, whereas in 2022, we recognized a net write-off of $771.5 million related to our Russian fleet. During the year ended December 31, 2023, our adjusted net income and diluted earnings per sharebefore income taxes2 was $733.6 million compared to $659.9 million for the year ended December 31, 20172022. Our adjusted diluted earnings per share before income taxes for the full year 2023 was due$6.58 compared to $5.89 for the full year 2022. The increase in our adjusted net income before income taxes and adjusted diluted earnings per share before income taxes primarily relates to the $1.2 billion increase in the net book value of our operating lease portfolio, and there-measurement of our U.S. deferred tax liabilities associated with the enactment of the Tax Reform Act, resulting in a tax benefit of $354.1 million.revenues as discussed above, partially offset by higher interest expense. Ourpre-tax profit margin return on common equity for the year ended December 31, 2017 was 40.2%2023 increased to 11.8% as compared to 40.9% for(3.0)% in 2022 driven primarily by the year ended December 31, 2016.increase in net income attributable to common stockholders discussed above.

Dividend Increase.Increased Return of Capital. On November 8, 2017,3, 2023, our Board of Directors approved an increase in our quarterly cash dividend of 33%on our Class A Common Stock by 5%, from $0.075$0.20 per share to $0.10$0.21 per share. This dividend, paid on January 10, 2024, marked our 44th consecutive dividend since we declared our first dividend in 2013 and our eleventh consecutive annual dividend increase over that time.

| 2 | Our adjusted net income before income taxes and adjusted diluted earnings per share before income taxes exclude the effects of certain non-cash items, one-time or non-recurring items that are not expected to continue in the future and certain other items, such net write-offs and recoveries related to our former Russian fleet. Adjusted net income before income taxes and adjusted diluted earnings per share before income taxes are measures of financial and operational performance that are not defined by U.S. Generally Accepted Accounting Principles (“GAAP”). See Appendix A for a discussion of adjusted net income before income taxes and adjusted diluted earnings per share before income taxes as non-GAAP measures and a reconciliation of these measures to net income attributable to common stockholders. |

2024 Proxy Statement | Air Lease Corporation | iii

Workforce Productivity. As of December 31, 2017,2023, we had 87 full-time163 employees and $15.6$30.5 billion of total assets. Per employee, our revenuetotal revenues, net income attributable to common stockholders, and adjusted net income before income taxes for the year ended December 31, 2017 was2023 were approximately $17.4$16.5 million, $3.5 million and $8.7$4.5 million, respectively.

For a comprehensive discussion of our financial results, please review our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, which was filed with the SEC on February 15, 2024 and is available at http://www.airleasecorp.com/investors.

2018 Proxy Statement

iv | Air Lease Corporation | iii2024 Proxy Statement

Corporate Governance HighlightsBoard Matrix

We maintain governance practices that we believe establish meaningful accountability for our Company and our Board, including:

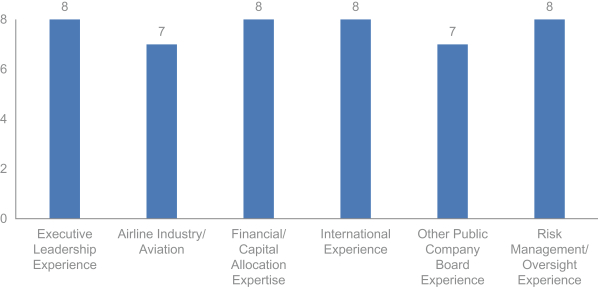

Our eight members of the Boardnine director nominees are highly experienced and possess the necessary skills and balance of perspectives to oversee our unique business. Set forth below is a summary of the Board’s collectiveeach director nominee’s qualifications experiences and backgrounds.experience, certain demographical information, as well as their committee membership. More detailed information is provided in each director nominee’s biographical information beginning on page 11.19.

iv | Air Lease Corporation | 2018 Proxy Statement

Director Nominees

| Name | Age | Director Since | Independent | Occupation | Committee

| Other Boards | ||||||||||||

A

| NCG

| Com

| ||||||||||||||||

Robert A. Milton | 57 | 2010 | ✓ | Retired Chairman & CEO, ACE Aviation Holdings and Air Canada

| M | C | M | • United Continental Holdings | ||||||||||

Matthew J. Hart | 65 | 2010 | ✓ | Retired President & COO, Hilton Hotels Corporation | C | M | • American • American

| |||||||||||

Cheryl Gordon Krongard | 62 | 2013 | ✓ | Retired Senior Partner, Apollo Management

| M | • Xerox | ||||||||||||

Marshall O. Larsen | 69 | 2014 | ✓ | Retired Chairman, President & CEO, Goodrich Corporation | M | • Becton, • Lowe’s • United

| ||||||||||||

John L. Plueger | 63 | 2010 | Chief Executive Officer & President, Air Lease Corporation

| • Spirit AeroSystems Holdings | ||||||||||||||

Ian M. Saines | 55 | 2010 | ✓ | Chief Executive, Funds Management Challenger Limited

| M | |||||||||||||

Ronald D. Sugar | 69 | 2010 | ✓ | Retired Chairman & CEO, Northrop Grumman Corporation

| M | C | • Amgen • Apple • Chevron | |||||||||||

Steven F.Udvar-Házy | 72 | 2010 | Executive Chairman, Air Lease Corporation

| • SkyWest | ||||||||||||||

M = Member; C = Chair

Committees: Audit = A; Nominating and Corporate Governance = NCG; Compensation = Comp

|  |  |  |  |  |  |  |  | ||||||||||

| Udvar-Házy | Plueger | Milton | Hart | Krongard |

Hollingsworth | Larsen | McCaw | Saines | ||||||||||

Qualifications and Experience | ||||||||||||||||||

Executive Leadership Experience | ● | ● | ● | ● | ● | ● | ● | ● | ● | |||||||||

Airline Industry/Aviation Expertise | ● | ● | ● | ● | ● | ● | ||||||||||||

Financial/Capital Allocation Expertise | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||

International Experience | ● | ● | ● | ● | ● | ● | ● | ● | ● | |||||||||

Risk Management and Oversight Experience | ● | ● | ● | ● | ● | ● | ● | ● | ● | |||||||||

Other Public Company Board Experience | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||

Committee Membership | ||||||||||||||||||

Audit | ● |  | ● | ● | ||||||||||||||

Nominating & Corporate Governance |  | ● | ● | ● | ||||||||||||||

Leadership Development & Compensation | ● |  | ● | ● | ||||||||||||||

Independent | ||||||||||||||||||

| ● | ● | ● | ● | ● | ● | ● | ||||||||||||

Board Tenure | ||||||||||||||||||

Years | 14 | 14 | 14 | 14 | 10 | 3 | 10 | 4 | 14 | |||||||||

Demographics | ||||||||||||||||||

Gender | ||||||||||||||||||

Female | ● | ● | ● | |||||||||||||||

Male | ● | ● | ● | ● | ● | ● | ||||||||||||

Race/Ethnicity | ||||||||||||||||||

African American or Black | ● | |||||||||||||||||

White | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||

Age | ||||||||||||||||||

Years | 78 | 69 | 63 | 71 | 68 | 57 | 75 | 61 | 61 | |||||||||

|

Committee Chair |

2018 Proxy Statementv | Air Lease Corporation | v2024 Proxy Statement

Executive Compensation Highlights

Compensation Philosophy

Our executive compensation program is designed to attract, retain and motivate the highest caliber executives in the aircraft leasing industry by offering a comprehensive compensation program that is attractive enough to entice and retain successful senior executives. We also believe it is important that our compensation program attractattracts the mosthighly talented executives that areexecutive who is experienced and capable of managing our aircraft fleet with a very small team to help drive our profitability.

At the end of 2023, we had total revenues of $2.7 billion and 163 employees, with total compensation expense representing 4.0% of revenues. We believe that our ratio of employees to total revenue and net income attributable to common stockholders compares favorably to other companies in capital-intensive businesses. The chart below shows our total revenues and net income attributable to common stockholders per employee as of December 31, 2023 as compared to the average of our 2023 custom benchmark group: | COMPENSATION EXPENSE 4% 2023 total revenues |

Pay-for-Performance Philosophy

Our executive compensation program is also designed to reward our executives for contributing to the endachievement of 2017,our annual and long-term objectives. We set performance metrics based on our 2023 financial plan, with the goal of aligning our performance-based compensation with the creation of long-term value for our stockholders. In 2023, we made changes to our compensation program, including increasing the weighting of the financial metrics in our annual bonus program from 60% to 70%, while simultaneously reducing the weighting of the strategic objectives from 40% to 30%. We had total revenuesreduced the relative weighting of $1.5 billionthe financial metrics included in our annual bonus program during the COVID-19 pandemic and we had 87 employees, resultingour industry’s recovery given the difficulty in 2017 revenue per employeeforecasting our financial performance during that period. We also kept the substantial majority of approximately $17.4 millionour long-term incentive awards tied to performance-based objectives with the relative split between performance and totaltime-based long-term incentive awards for 2023 consisting of 50% Book Value RSUs, 25% TSR RSUs and 25% time-based RSUs.

2024 Proxy Statement | Air Lease Corporation | vi

Our recent long-term incentive performance award payouts demonstrate the rigor of the long-term performance targets set by the leadership development and compensation expense representing 3.9% of revenues. committee:

We believe that our directors’ and employees’ ownership of our stock is critical to alignment with our stockholders. Our employees and independent directors collectively owned approximately 7% of the ratioCompany’s outstanding Class A Common Stock as of employees to total assets and total compensation as a percentage of revenues compares favorably to other companies in capital-intensive businesses. March 4, 2024.

vii | Air Lease Corporation | 2024 Proxy Statement

Compensation Governance

Our leadership development and compensation committee regularly reviews our compensation governance practices to ensure we are incentivizing hard work and high performance while also managing risk. OurHighlights of our executive compensation program currently includes the following features:include:

What We Do:

| ✓ | Pay for Performance |

| ✓ | Double-Trigger Change in Control Provisions |

| ✓ |

Manage the use of equity incentives conservatively with a net equity burn rate |

| ✓ | Tally Sheets |

| ✓ | Director Stock Ownership Guidelines |

| ✓ | Executive Officer Stock Ownership Guidelines (6X for CEO and Executive Chairman and 2X for other executives; excludes unvested performance shares) |

| ✓ | Mitigate Undue Risk |

| ✓ | Independent Compensation Consultant |

| ✓ | Annual |

| ✓ | Clawback Policy in compliance with current NYSE Listing Standards |

| ✓ | Annual “Say-on-Pay” |

| ✓ | Robust Stockholder Engagement Program |

What We Don’t Do:

| x | Directors or Employee Hedging |

| x | Executive Officer or Director Pledging |

| x | Tax Gross-Ups (except in connection with foreign assignments) |

| x | Dividend or Dividend Equivalents on Unvested Equity Awards |

| x | Re-Price Stock Options |

| x | Pension Benefits (other than 401(k)) |

| x | Employment Agreements (except in connection with foreign assignments) |

| x | Equity awards with less than 1-year vesting |

| x | Uncapped payouts in our incentive plans |

| x | No liberal share recycling of stock options or stock appreciation rights |

| x | Stock Option Awards |

| x | Equity plan evergreen provisions |

| x | Guaranteed cash incentives, equity compensation or salary increases for NEOs (except upon death or disability) |

| x | Excessive perquisites or other benefits |

Pay-for-Performance Philosophy

Our executive compensation program is designed to reward our executives for contributing to the achievement of our annualExtensive Stockholder Engagement and long-term objectives. We set robust goals to align performance-based compensation with the creation of long-term value for our stockholders. We also believe that our directors and employees ownership of our stock is critical to alignment with our stockholders. Our 87employees along with our independent directors collectively own over 9% of the Company.

vi | Air Lease Corporation | 2018 Proxy Statement

Engagement with Stockholders and Compensation Program and Disclosure EnhancementsDemonstrated Responsiveness

To better understand our investors’ perspectives regarding our executive compensation program foras well as a variety of corporate governance and sustainability topics, we engage with our investors throughout the last several yearsyear via individual or group meetings, at industry and bank conferences, as well as through our investor relations team. Following the 2023 annual stockholders meeting, in addition to our regular investor engagement efforts, the leadership development and compensation committee also oversaw dedicated stockholder outreach efforts in light of the results of our 2023 “say-on-pay” advisory vote. Engagement with our stockholders helps us better understand evolving priorities and perspectives, gives us an opportunity to elaborate upon our initiatives with relevant experts, and fosters constructive dialogue. We take feedback and insights from our engagement with investors into consideration as we have engaged in stockholder outreach. We spokereview and evolve our business and governance practices and disclosures, and further share them with our Board of Directors and leadership development and compensation committee, as appropriate.

2024 Proxy Statement | Air Lease Corporation | viii

Following the 2023 annual stockholders in the spring of 2017 after issuing our proxy statement and again in late 2017 and early 2018. In our most recent outreach,meeting, we engaged with stockholders holding 44%holders of over 70% of outstanding shares of our Class A Common Stock (none of whom were our employees or directors). WhileA summary of what we regularly communicateheard during these engagement sessions, along with our stockholders, during our most recent outreachthe changes we contacted our large stockholders to specifically discuss our compensation philosophy and program and to listen to their feedback. The compensation committee considered our stockholders’ views when making decisions about changes to our 2017 and 2018 compensation programs.

We continued to enhance our executive compensation programimplemented in response, to evolving compensation practices and feedback from our stockholder engagement efforts, specifically by making the following responsive changes:is below:

| ||||||

| How We Responded | ||||||

| Stockholders expressed concern over the goal rigor of metrics in our annual bonus program —specifically, that goals for some metrics were set below prior year actual results | ||||||

| We incorporated stockholder feedback on this topic in several ways:

|

Second, we (i) We set the (ii) We significantly increased the outperformance required to obtain above target payouts on all of the

| ||||

(iv) We increased the weighting of our | ||||||

| ||||||

strategic goals.

| ||||||

| ||||||

|

| We almost doubled the | ||||

2018ix | Air Lease Corporation | 2024 Proxy Statement

| What We Heard | How We Responded | |||

| Stockholders indicated support for our proposal to return our annual bonus program to pre-pandemic historical financial and strategic goal splits |  | For our 2024 annual bonus program, our leadership development and compensation committee increased the weighting of the financial metrics from 70% to 80%, while simultaneously reducing the weighting of the strategic objectives from 30% to 20%. This weighting is consistent with the weighting of the financial and strategic metrics in our annual bonus plan prior to the pandemic | ||

| Stockholders indicated a desire for more specific goals and target achievement levels for strategic metrics included in our annual bonus program |  | We updated the strategic metrics in our 2023 and 2024 annual bonus program to be entirely comprised of metrics that can be quantitatively assessed for achievement and have included disclosure of these goals in this Proxy Statement | ||

| Stockholders asked us to provide increased disclosure in our proxy statement regarding the role of our Executive Chairman |  | We have added increased disclosure in this Proxy Statement to help our stockholders better understand the important role of our Executive Chairman, including his significant engagement as a member of our executive team. See the section titled, “Compensation Discussion and Analysis—Our Named Executive Officers” in this Proxy Statement | ||

| Some stockholders expressed concern over the pay of our Executive Chaiman relative to our CEO |  | While some stockholders expressed concern over the close proximity of compensation of our Executive Chairman and CEO, many stockholders noted that they look at the quantum of overall executive compensation, and because our overall named executive officer compensation is generally in line with other similarly sized companies, most stockholders indicated our CEO and Executive Chairman compensation structure was not problematic. Additionally, many stockholders acknowledged that our CEO and Executive Chairman compensation structure was appropriate in light of our Executive Chairman’s importance in the management of customer and OEM relationships and active, full-time employment with the Company | ||

| Stockholders generally supported and requested the continued inclusion of a sustainability metric in our annual bonus program |  | Our 2023 and 2024 annual bonus program include a strategic metric based on the percentage of our fleet comprised of the newest generation aircraft | ||

| Some stockholders noted they would like to see increased scope emissions disclosure, including Scope 3 emissions disclosure |  | We have increased our scope emissions disclosures in recent years, with 2023 being our second year providing Scope 1 and Scope 2 emissions disclosure, and we plan to disclose all required scope emissions in compliance with all applicable corporate sustainability reporting directives as those are adopted or phase in | ||

2024 Proxy Statement | Air Lease Corporation | viix

| ||||||

| ||||||

| ||||||

viii | Air Lease Corporation | 2018 Proxy Statement

Air Lease Corporation

2000 Avenue of the Stars, Suite 1000N

Los Angeles, California 90067

(310) 553-0555

Proxy Statement for the

Stockholders

|

of Directors

|

Members and Meetings of the Board of Directors

OurThe Board of Directors (the “Board of Directors”) of Air Lease Corporation (“we,” “our,” “us,” or the “Company”) is currently composed of eightnine members: Matthew J. Hart, Yvette Hollingsworth Clark, Cheryl Gordon Krongard, Marshall O. Larsen, Susan McCaw, Robert A. Milton, John L. Plueger, Ian M. Saines, Ronald D. Sugar and Steven F.Udvar-Házy. Our directors serve for one-year terms until the next annual meeting of stockholders, and until their respective successors are duly elected and qualified.qualified or until his or her resignation or removal. Certain information regarding our directors is set forth below inProposal 1: Election of Directors.

Our Board of Directors held sevensix meetings in 2017.2023. Each of the directorsdirector nominees standing forre-election election at the Annual Meeting attended at least 75%100% of the meetings of the Board of Directors and the committees of the Board of Directors on which he or she served in 2017.2023 other than one director who attended 86% of the meetings of the Board of Directors and the committees of the Board of Directors on which they served in 2023. We expect, but do not require, our directors to attend the annual meeting of stockholders each year. AllEight of our directors who stood for election atnine director nominees attended the 20172023 annual meeting other than Mr. Saines attended that meeting.

Each director will qualify as “independent” pursuant toUnder the corporate governance rules of the New York Stock Exchange (the “NYSE”) listing standards only if our, a majority of the members of the Board of Directors must satisfy the NYSE criteria for “independence.” No director qualifies as independent unless the Board of Directors affirmatively determines that he or she has no material relationship with us, either directly or as a partner, stockholder or officer of an organization that has a relationship with us. Accordingly, ourThe Board of Directors has affirmatively determined that sixseven of our eightnine current directors, Mr. Hart, Ms. Hollingsworth Clark, Ms. Krongard, Mr. Larsen, Ms. McCaw, Mr. Milton and Mr. Saines and Dr. Sugar, were independent in accordance with the NYSE rules during the periods in 20172023 and 20182024 that theysuch directors served as directors of ouron the Board of Directors. Mr. Milton serves as our lead independent director.Messrs. Udvar-Házy and Plueger are not independent because they are employees of Air Lease Corporation (the “Company”).the Company.

20182024 Proxy Statement | Air Lease Corporation | 1

Board of Directors’ Leadership

The Board of Directors currently has no firm policy as to whether the roles of Chairman of the Board of Directors and Chief Executive Officer should be combined or separate. Instead, our Board of Directors believes that our leadership structure should be considered in the context of our Company’s circumstances at any given time, including company culture, strategic objectives and any challenges we may be facing. Therefore, our Board of Directors evaluates its leadership structure annually to ensure that the most optimal structure is in place for our Company’s needs, – which may evolve over time.

Our Corporate Governance Guidelines provide that in the event thatif the Chairman of the Board of Directors is not an independent director, the nominating and corporate governance committee may designate an independent director to serve as “Lead Director,” who shall be approved by a majority of the independent directors. The Board of Directors believes having an independent Lead Director provides an appropriate balance between strong Company leadership and appropriate oversight by independent directors.

As part of our Board of Directors’ long-term succession plans for the Company, effective July 1, 2016, the Board established the separate executive position of Executive Chairman of the Board ofDirectors. Mr. Udvar-Házy, our founder and former Chief Executive Officer, now serves as the Executive Chairman of the Board of Directors, and in addition to his executive officer role, chairs the meetings of the Board of Directors and works closely with Robert A. Milton, our independent Lead Director. John L. Plueger, our Chief Executive Officer, also works closely with Mr. Milton in his role.

The role of the independent Lead Director helps ensure oversight by an active and involved independent Board of Directors, while Mr.Udvar-Házy’s continued engagement as Executive Chairman of the Board enables the Company and the Board of Directors to benefit from his deep knowledge, industry relationships, and operational experience.

John L. Plueger, our Chief Executive Officer, also works closely with Mr. Milton has been elected annually by the independent directors of the Board to servein his role as independent Lead Director since our initial public offering in 2011. Director.

In this role, Mr. Milton has the following responsibilities as set forth in our Corporate Governance Guidelines and as requested by the Board of Directors:

| • | chair meetings of the non-management or independent directors; |

| • | call meetings of the non-management or independent directors, if deemed appropriate; |

provide input on the selection of thenon-management independent directors;any new director;

facilitate communications between other members of the Board and the Executive Chairman and/or Chief Executive Officer;

work with the Executive Chairman in the preparation of the agenda for each meeting;

work with the Executive Chairman in determining the need for special meetings;

otherwise consult with the Executive Chairman and/or the Chief Executive Officer on matters of governance and Board performance.performance;

report the results of the annual performance evaluation of the Executive Chairman and the Chief Executive Officer, to each individual; and

be available, as appropriate, for consultations and direct communication with stockholders.

Mr. Milton also serves on each committee of the Board. The Board of Directors believes that Mr. Milton’s extensive aviation industry experience, chief executive officer experience, as well as other board experience make him well suited to serve as its independent Lead Director.

2 | Air Lease Corporation | 2024 Proxy Statement

The Board of Directors believes that the leadership structure with a strong independent Lead Director on the one hand, and knowledgeable and experienced Executive Chairman of the Board of Directors on the other, provides balance and is in the best interest of the Company.

Corporate Governance Guidelines

2 | Air Lease Corporation | 2018 Proxy Statement

Our Board of Directors has adopted Corporate Governance Guidelines (the “Guidelines”) to assist it in the exercise of its duties and responsibilities and to serve the best interests of the Company and our stockholders. The Guidelines describe (i) the Lead Director’s and the Board of Directors’ responsibilities, (ii) the qualification criteria for serving as a director, including diversity considerations and over-boarding limits, (iii) the requirement that a director must offer to resign if the Board has determined that an actual conflict of interest arises with respect to the director which is not waived by the Board or such director fails to receive a majority vote at an annual meeting (with any such resignation being subject to review and acceptance by the full Board of Directors), (iv) the requirement that directors are subject to the Company’s Code of Business Conduct described below in the section titled “The Board of Directors’ Role in Governance Oversight” and (v) the standards for the conduct of meetings and establishing and maintaining committees. In addition, the Guidelines (i) contain a “Rooney Rule” requirement to actively include women and minority candidates in the pool of qualified director candidates from which directors are to be selected, (ii) confirm that the directors will have full and free access to officers and employees of the Company and have authority to retain independent advisors as necessary and appropriate in carrying out their activities, (iii) establish frameworks for director compensation, director orientation and continuing education, and an annual evaluation of the Board and its committees and of the Guidelines, (iv) charge the leadership development and compensation committee with oversight of management evaluation and succession, and (v) detail the Company’s policies regarding confidentiality and communications between our Board of Directors and the press and media on matters pertaining to the Company and clarify our practices regarding communications to our Board of Directors by stockholders and other interested parties.

Our Board of Directors periodically reviews the Guidelines and makes amendments from time to time. The Guidelines are available on our website at www.airleasecorp.com.

Executive Sessions ofNon-Employee Directors

As part of the Board of Directors’ regularly scheduled meetings, thenon-employee directors meet in executive session. Anynon-employee director can request additional executive sessions. Mr. Milton, as lead independent director,Lead Director, schedules and chairs the executive sessions.

Committees of the Board of Directors

Our Board of Directors has three standing committees: an audit committee, a leadership development and compensation committee and a nominating and corporate governance committee. Our Board of Directors has determined that each of these committees is composed solely of independent directors under the applicable NYSE rules. Our Board of Directors has adopted a charter for each committee that is available on our website at www.airleasecorp.com.

All of the independent members of the Board of Directors are invited to attend all committee meetings and it is the practice of the independent directors to attend the meetings of committees upon which they do not serve. The independent directors believe that their attendance at these meetings enhances their understanding of the business and permits them to spend more time on issuessubstantively contribute at the meetings of the full Board of Directors.

Audit Committee

Our audit committee consists of Messrs. Hart, Milton and Saines. Mr. Hart is the Chairman of the audit committee. Our audit committee’s duties include, but are not limited to, monitoring (1) the integrity of the financial statements of the Company, (2) the independent registered public accounting firm’s qualifications and independence, (3) the performance of our internal audit function and independent registered public accounting firm, (4) our compliance with legal and regulatory requirements and (5) our overall risk profile. Our audit committee is a separately designated standing audit committee as defined in Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Our audit committee must at all times be composed exclusively of directors who are “financially literate” as defined under the NYSE listing standards. The audit committee also must have at least one member who has past employment experience in finance or accounting, requisite professional certification in accounting or other comparable experience or background that results in the individual’s financial sophistication, and who qualifies as an “audit committee financial expert,” as defined under the rules and regulations of the Securities and Exchange Commission (“SEC”). Our Board of Directors has determined that each member of our audit committee is financially literate and is an “audit committee financial expert.” In addition to being “independent” under NYSE rules, each member of our audit committee also meets the independence requirements of the SEC for purposes of serving on an audit committee.

Our audit committee held four meetings in 2017.

Nominating and Corporate Governance Committee

Our nominating and corporate governance committee consists of Messrs. Milton, Hart, and Larsen and Dr. Sugar. Mr. Milton is the Chairman of the nominating and corporate governance committee. Our nominating and corporate governance committee monitors the implementation of sound corporate governance principles, practices and risks and will, among other things: (1) identify individuals believed to be qualified to become a member of our Board of Directors and recommend to the Board candidates for all directorships to be filled, (2) periodically review and recommend changes, as appropriate, to our corporate governance guidelines and (3) annually oversee the evaluation of our Board of Directors and its committees. Our nominating and corporate governance committee also reviews and approves all related party transactions in accordance with our policies with respect to such matters.

Our nominating and corporate governance committee held four meetings in 2017.

20182024 Proxy Statement | Air Lease Corporation | 3

Compensation Committee

Our compensation committee consists of Dr. Sugar, Ms. Krongard and Mr. Milton. Dr. SugarBelow is the Chairman of the compensation committee. Our compensation committee has overall responsibility for (1) evaluating, and approving or recommending, alla summary of our compensation plans, policiescurrent committee membership information along with brief descriptions of each committee’s roles and programs as they affect the executive officers, including the Executive Chairman and the Chief Executive Officer, (2) overseeing the evaluation of management and succession planning for executive officer positions, (3) at least annually reviewing the compensation (both cash and equity based award compensation) ofnon-employee directors for service on the Board and its committees and recommending any changes to the Board for approval and (4)responsibilities:

Audit Committee | ||

Members Mr. Hart (Chair) Ms. Hollingsworth Clark Mr. Milton Mr. Saines All Independent/Financially Literate/Financial Experts(1) | 2023 Meetings • Held four meetings • 100% attendance | |

Responsibilities. The responsibilities of the audit committee include, but are not limited to, overseeing: • the integrity of the financial statements of the Company; • the independent registered public accounting firm’s qualifications and independence; • the performance of our internal audit function and independent registered public accounting firm; • our compliance with legal and regulatory requirements; • our accounting and system of internal controls; • our cybersecurity program; and • our overall policies and practices with respect to risk assessment and risk management. | ||

| (1) | Our Board of Directors has determined that each member of our audit committee is “financially literate” under applicable rules of the NYSE and is an “audit committee financial expert,” as defined under the rules and regulations of the Securities and Exchange Commission (“SEC”). In addition, each member of our audit committee also meets the enhanced independence requirements pursuant to Rule 10A-3(b)(i) of the Securities Exchange Act and NYSE rules for purposes of serving on an audit committee. |

Nominating and Corporate Governance Committee | ||

Members Mr. Milton (Chair) Mr. Hart Ms. Krongard Mr. Larsen All Independent | 2023 Meetings • Held four meetings • 100% attendance | |

Responsibilities. Our nominating and corporate governance committee monitors the implementation of sound corporate governance principles, practices and risks and will, among other things: • identify individuals qualified to become a member of our Board and recommend to the Board of Directors candidates to be appointed to fill vacancies and newly created directorships consistent with criteria approved by the Board and as further described under the section titled “Consideration of Director Candidates”; • periodically review and recommend changes, as appropriate, to our corporate governance documents; • review stockholder proposals submitted in accordance with our bylaws; • annually oversee the evaluation of the Board of Directors and its committees; and • review and approve all related person transactions in accordance with our Related Persons Transaction Policy. | ||

4 | Air Lease Corporation | 2024 Proxy Statement

Leadership Development and Compensation Committee | ||

Members Ms. Krongard (Chair) Ms. McCaw Mr. Larsen Mr. Milton All Independent(1) | 2023 Meetings • Held five meetings • 100% attendance | |

Responsibilities. The responsibilities of the leadership development and compensation committee include, but are not limited to: • overseeing our overall compensation structure, policies and programs; • reviewing and approving corporate goals and objectives relevant to the compensation of our Chief Executive Officer and Executive Chairman, reviewing the performance of each such individual in light of those goals and objectives and recommending to the independent directors of the Board the compensation level for each such individual based on this evaluation; • reviewing and approving corporate goals and objectives relevant to the compensation of our other named executive officers, reviewing the performance of each such individual in light of those goals and objectives and determining the compensation level for each such individual based on this evaluation and the recommendation of our Chief Executive Officer and/or Executive Chairman; • administering, and making recommendations to the Board of Directors with respect to our incentive-compensation and equity-based compensation plans that are subject to Board approval; • reviewing and evaluating the Company’s programs and practices related to leadership development and human capital management, including periodically reviewing diversity and inclusion programs and practices and succession plans relating to positions held by executive officers and making recommendations to the Board regarding the selection of individuals to fill these positions; • at least annually reviewing the compensation (both cash and equity-based compensation) of non-employee directors for service on the Board and its committees and recommending any changes to the Board for approval; • broadly overseeing matters relating to the attraction, motivation, development and retention of employees; and • reviewing the risk exposure related to the areas of its responsibility. | ||

| (1) | Our Board of Directors has determined that each member of the leadership development and compensation committee satisfies the additional independence requirements specific to compensation committee membership under NYSE rules and qualifies as a “non-employee director” under SEC rules for purposes of serving on a compensation committee. In making this determination, the Board of Directors considered whether the director has a relationship with the Company that is material to the director’s ability to be independent from management in connection with the duties of a member of the leadership development and compensation committee. |

In fulfilling its responsibilities, the leadership development and compensation committee may delegate to management or to a subcommittee of the leadership development and compensation committee. The leadership development and compensation committee has delegated to certain senior membersthe Company’s Executive Chairman and Chief Executive Officer, each of managementwhom is a member of the Board of Directors, the authority to make RSU grants in 20182023 and 2024 to employees (at or below the vice president level) on the same

2024 Proxy Statement | Air Lease Corporation | 5

terms as grants made by the leadership development and compensation committee to other officers and employees on the same terms as the executive officers,level, subject to ana cap on both the aggregate number of RSUs approved for issuance by the leadership development and compensation committee.committee and the dollar amount of any individual award.

The leadership development and compensation committee also oversees preparation of the compensation discussion and analysis to be included in our annual proxy statement, recommends to the Board of Directors whether to so include the compensation discussion and analysis, and provides an accompanying report to be included in our annual proxy statement. The committee also considers the results of the most recent stockholder advisory vote on executive compensation and to the extent the committee determines it appropriate to do so, takes such results into consideration in connection with its review and approval of executive officer compensation.

TheIn accordance with the leadership development and compensation committee’s charter, the leadership development and compensation committee has engagedmay retain independent compensation advisors and other management consultants. In 2023, the leadership development and compensation committee retained Exequity LLP (“Exequity”), a nationally recognized independent compensation consultant, to provide advice with respect to compensation decisions for our executive officers and non-employee directors.

Compensation Committee Interlocks and Insider Participation

Each of Ms. Krongard, Ms. McCaw, Mr. Larsen and Mr. Milton served on thenon-employee leadership development and compensation committee for all of 2023. None of the members of our leadership development and compensation committee has at any time been one of our officers or employees. None of our executive officers serves, or in the past year has served, as a member of the board of directors or the leadership development and compensation committee of any entity that has one or more executive officers who serve on our Board of Directors or leadership development and our executive officers.

In addition to being “independent” under NYSE rules, each member of our compensation committee also qualifies as a“non-employee director” under SEC rules and as an “outside director” under Section 162(m) of the Internal Revenue Code for purposes of serving on a compensation committee.

Our compensation committee held five meetings in 2017.

The Board and Committee Annual Self-Evaluation

To ensure that the Board of Directors and each Board committee functions effectively, the nominating and corporate governance committee and the Board of Directors annually conducts aan annual self-evaluation to identify and assess areas for improvement. The written assessment focuses on the Board composition and its role, the operation of the Board, the Board’s processes relating to the Company’s strategy, financial position and corporate governance and the function and effectiveness of the Board committees. The independent lead directorLead Director leads the evaluation process which includes collecting the assessment feedback and conducting aone-on-one conversation with each director.

In connection with the one-on-one conversation with each director, the Lead Director asked the directors to discuss several additional questions on critical topics impacting the Company in 2023, including the Board’s evaluation of the Company’s sales strategy in view of significant increases in aircraft sales, as well as the Company’s risk management strategy in light of ongoing geopolitical instability in certain regions.

The Lead Director sharesdiscusses the results of the evaluations and feedback received with the Boardnon-employee directors in executive session at its February meeting each year, then shares the results with the employee directors and, as necessary, the Board implements resulting recommendations.

6 | Air Lease Corporation | 2024 Proxy Statement

Consideration of Director Candidates

Qualifications of Director Candidates

Our nominating and corporate governance committee is responsible for identifying and evaluating director candidates based on the perceived needs of the Board of Directors at the time. Our Board of Directors has established criteria for identifying and evaluating individuals qualified to become members of the Board of Directors, which it uses as a guideline in considering director nominations. The criteria, which are included in our Guidelines, include but are not limited to:

The nominee’s reputation for integrity, honesty and adherence to high ethical standards.

The nominee’s judgment and independence of thought, financial literacy, leadership experience and a fit of abilities and personality that helps build an effective, collegial, and responsive Board of Directors.

The nominee’s demonstrated business acumen, experience and ability to exercise sound judgments in matters that relate to the current and long-term objectives of the Company and willingness and ability to contribute positively to the decision-making process of the Company.

The nominee’s commitment to understand the Company and its industry, including its competitors.

The absence of conflicting time commitments and the nominee’s commitment to regularly attend and participate in meetings of the Board and its committees.

The nominee’s background, knowledge, education, experience, skills, age, and gender, ethnic and geographic diversity. The nominating and corporate governance committee will actively include, and will instruct any search firms utilized to include, women and racial and/or ethnic minority candidates in the pool of potential director candidates from which new directors are selected.

The nominee’s interest and ability to understand the sometimes conflicting interests of the various constituencies of the Company, which include stockholders, employees, customers, creditors and the general public, and to faithfully represent the interests of all stockholders.

The impact of the nominee’s appointment on overall Board of Directors balance, breath of experience, collective knowledge, perspective and ability.

The criteria established by the Board of Directors are not exhaustive and the nominating and corporate governance committee and the Board of Directors may consider other qualifications and attributes that they believe are appropriate in evaluating the ability of an individual to serve as a director. The nominating and corporate governance committee reviews and assesses the nomination criteria periodically.

The nominating and corporate governance committee does not have a formal policy specifying how diversity of background and personal experience should be applied in identifying or evaluating director candidates, and a candidate’s background and personal experience, while important, does not necessarily outweigh other attributes or factors the nominating and corporate governance committee considers in evaluating candidates. However, the Board of Directors is committed to identifying candidates with gender, racial and/or ethnic diversity and our Guidelines contain a “Rooney Rule” requirement to actively include women and minority candidates in the pool of qualified director candidates from which directors are to be selected.

Our nominating and corporate governance committee has not retained professional search firms to assist it in recruiting potential director candidates.

2024 Proxy Statement | Air Lease Corporation | 7

Stockholder-Recommended Director Candidates

Any stockholder may recommend a director candidate for our nominating and corporate governance committee to consider by submitting the candidate’s name and qualifications to us addressed to our Corporate Secretary (the “Secretary”) at the address for our principal executive office listed on the cover page of this Proxy Statement. Candidates recommended by a stockholder are evaluated in the same manner and using the same criteria as used for any other director candidate.

Stockholders of record seeking to nominate a candidate for election as a director at our annual meeting of stockholders (as opposed to making a recommendation to the nominating and corporate governance committee as described above) or to bring other business before our annual meeting of stockholders, may do so by providing timely notice of their intent in writing by the deadlines specified in our Fourth Amended and Restated Bylaws (the “Bylaws”). For more information, see the section below titled “Stockholder Proposals and Director Nominations for our 2025 Annual Meeting of Stockholders.”

Communications with the Board of Directors

Stockholders and any other interested parties who wish to communicate with the Board of Directors or an individual director, including our independent Lead Director or our independent directors as a group, or any Board committee or any chairperson of any Board committee, by either name or title, may send written communications to the Secretary at the address for our principal executive office listed on the cover page of this Proxy Statement. All such communications will be opened by the Secretary or his or her designee for the sole purpose of determining whether the contents represent a message to the Company’s directors. The Secretary will forward copies of all correspondence that, in the opinion of the Secretary, deals with the functions of the Board or its committees or that he or she otherwise determines requires the attention of any member, group or committee of the Board. The Secretary will not forward junk mail, job inquiries, business solicitations, offensive or otherwise inappropriate materials.

8 | Air Lease Corporation | 2024 Proxy Statement

Board of Directors’ Role in the Oversight of the Company’s |

The Board of Directors’ Role in Risk Oversight

The Board of Directors has delegated risk oversight responsibilities to the audit committee exceptprimary responsibility for risks relating to executive compensation.risk oversight. In accordance with its charter, the audit committee is responsible for monitoring the Company’s policies and practices with respect to risk assessment and risk management. The audit committee periodically meets with ourThis includes oversight of management’s implementation of the Company’s annual enterprise risk management assessment (the “ERM program”), which is an ongoing, enterprise-wide program designed to enable effective and efficient identification of, and management visibility into, critical enterprise risks over the short-, intermediate-, and long-term, and to facilitate the incorporation of risk considerations into decision making across the Company. In particular, the annual enterprise risk management assessment clearly defines risk management roles and responsibilities, brings together senior executivesmanagement and the Company’s external auditor to discuss among other

4 | Air Lease Corporation | 2018 Proxy Statement

things, materialrisk, promotes visibility and constructive dialogue around risks relevant to our business.the Company’s strategy and operations, and facilitates appropriate risk response strategies at the Board, committee, and management levels. Under the ERM program, management develops a holistic portfolio of the Company’s enterprise risks by performing targeted risk vulnerability assessments and incorporating information regarding specific categories of risk gathered from the Company’s technical, procurement, treasury, human resources, IT and legal teams, who provide input into this process and are responsible for the day-to-day monitoring, evaluating, reporting, and mitigating of their respective risk categories. The ERM program works in tandem with the Company’s accounting and financial reporting teams to align the risk identification and assessment with the Company’s existing disclosure controls and procedures. The audit committee also periodically meets with representatives of ourthe Company’s independent registered public accounting firm. The Chairmanfirm at least quarterly. As needed, the Chair of the audit committee reportsescalates issues relating to risk oversight to the full Board of Directors, regarding material risks as deemed appropriate.in a continuous effort to keep the Board of Directors adequately informed of developments that could affect the Company’s risk profile or other aspects of its business. The Board of Directors also considers specific risk topics in connection with strategic planning and other matters.

The audit committee’s risk management oversight also includes oversight of the Company’s cybersecurity program. Throughout the year as needed and on an annual basis, the audit committee receives updates on the cybersecurity program, including in connection with program enhancements, audits of the program, and employee cybersecurity training. Additional risk management oversight by the audit committee includes oversight of the Company’s compliance program. The Company’s compliance program is led by the Company’s General Counsel, Secretary and Chief Compliance Officer, who reports directly to the Company’s Chief Executive Officer. The Company’s General Counsel, Secretary and Chief Compliance Officer meets at least quarterly with the audit committee and Board of Directors to report on key ethics and compliance risks facing the Company and provides an annual compliance program update to the audit committee.

The Board of Directors has delegated to the leadership development and compensation committee provides oversight with respect to risks that may arise from our compensation arrangements and policies. This is accomplished on an ongoing basis through the compensation committee’s review and approval of specific arrangements and policies to ensure that they are consistent with our overall compensation philosophy and our business goals. The leadership development and compensation committee periodically discusses any compensation risk-related concerns with senior management and with its independent compensation consultant. The ChairmanChair of the compensation committee will reportreports to the full Board of Directors regarding any material risks as deemed appropriate. In view of this oversight and based on our ongoing assessment, we do not believe that our present employee compensation arrangements, plans, programs or policies are likely to have a material adverse effect on the Company.

2024 Proxy Statement | Air Lease Corporation | 9

The leadership development and compensation committee also provides oversight with respect to risks related to the Company’s leadership development and human capital management. This is accomplished through regular involvement by the committee with senior management in matters relating to the attraction, motivation, development and retention of employees.

The Board of Directors retains oversight of the risks related to corporate governance and sustainability practices that are not specifically delegated to the audit and leadership development and compensation committees, including environmental risks as discussed below. The Board of Directors has retained direct oversight of environmental risks in light of the Company’s core business strategy of focusing on the replacement market to assist airlines looking to replace aging aircraft with new, modern technology, fuel efficient jet aircraft.

The Board of Directors believes that its governance structure supports the Board’s role in risk oversight. IndependentWith the exception of environmental risk oversight conducted by the full Board of Directors, independent directors chair each of the Board committees responsible for risk oversight. The Company has a leadoversight and the Company’s independent director whoLead Director facilitates communication between senior management and directors, and all directors are involveddirectors.

The Board of Directors’ Role in the review of key enterprise risks.

Compensation Committee Interlocks and Insider ParticipationGovernance Oversight

None of the members of our compensation committee has at any time been one of our officers or employees. None of our executive officers serves, or in the past year has served, as a member of the board of directors or the compensation committee of any entity that has one or more executive officers who serve on ourThe Board of Directors or compensation committee.

Corporate Governance Guidelinesregularly reviews developing governance practices and, Codewhen appropriate, implements enhancements to our governance practices. Each year, the Board of Business Conduct

Corporate Governance Guidelines

OurDirectors dedicates time to discuss the business and competitive environment and evaluate the Company’s strategic goals and direction. Thereafter, the Board of Directors has adopted Corporate Governance Guidelines (the “Guidelines”)ongoing discussions of these topics at its regular meetings. We maintain governance practices that we believe establish meaningful accountability for our company and our Board, including:

All Directors except Executive Chairman and Chief Executive Officer are Independent

All Standing Board Committees Comprised Entirely of Independent Directors

Independent Lead Director with Clearly Defined Role and Responsibilities

Commitment to assist the Board Diversity with Three Female Directors, One of DirectorsWhom is from an Underrepresented Community

Requirement to Actively Include Women and Individuals From Minority Groups in the exercisePool of its dutiesPotential Director Candidates

Majority Vote Standard for Director Elections With Mandatory Director Resignation if Not Elected

All Directors Elected on an Annual Basis

Annual Board and responsibilitiesCommittee Evaluations

All Audit Committee Members are Financial Experts

Focus on Critical Risk Oversight Role

Ongoing Board Succession Planning - Management and Board Dialogue to serve the best interestsEnsure Successful Oversight of Succession Planning

Active Board Oversight of the Company’s Governance

Robust Director and Executive Officer Stock Ownership Guidelines

Prohibition on Short Sales, Transactions in Derivatives and Hedging of Company and our stockholders. The Guidelines are intended to serve as a flexible framework for the conduct of the Board of Directors’ business and not as a set of legally binding obligations. The Guidelines describe the Lead Director’s and the Board of Directors’ responsibilities, the qualification criteria for serving as a director, and standards for the conduct of meetings and establishing and maintaining committees. The Guidelines also confirm that the directors will have full and free access to officers and employees of the Company and have authority to retain independent advisors as necessary and appropriate in carrying out their activities. In addition, the Guidelines establish frameworks for director compensation, director orientation and continuing education, and an annual evaluation of the Board and its committees and of the Guidelines. Finally, the Guidelines charge the compensation committee with oversight of management evaluation and succession, and detail the Company’s policies regarding confidentiality and communications between our Board ofStock by Directors and the pressall Employees

Prohibition on Pledging of Company Stock by Directors and media on matters pertainingExecutive Officers

Clawback Policy for Executive Compensation in compliance with current NYSE Listing Standards

All Independent Directors are Invited to the Company. Our GuidelinesAttend Meetings of Committees they are available on our website at www.airleasecorp.com.not Members of and Regularly Attend those Meetings

10 | Air Lease Corporation | 2024 Proxy Statement

Code of Business Conduct and Ethics

Our Board of Directors has adopted a Code of Business Conduct and Ethics that applies to all ofdirectors, officers (including our directors, employeesprincipal executive officer, principal financial officer and officers.principal accounting officer) and employees. Among other things, the Code of Business Conduct and Ethics is

2018 Proxy Statement | Air Lease Corporation | 5

intended to ensure fair and accurate financial reporting, to promote ethical conduct and compliance with applicable laws and regulations given our worldwide operations, to provide guidance with respect to the handling of ethical issues, to foster a culture of honesty and accountability and to deter wrongdoing. It also requires disclosure to us of any situation, transaction or relationship that may give rise to any actual or potential conflict of interest. Such conflicts must be avoided unless approved by our nominating and corporate governance committee. The Code of Business Conduct and Ethics prohibits our employees, officers and directors from taking, or directing a third party to take, a business opportunity that is discovered through the use of our property.company resources. We encourage all employees to report concerns or wrongdoing. A copy of our Code of Business Conduct and Ethics is available on our website at www.airleasecorp.com.

The Board of Directors’ Role in Leadership Development and Succession Planning

The Company’s leadership is comprised of a small number of talented individuals, with extensive industry experience, capable of managing a capital-intensive business responsibly to drive our profitability and growth. At the end of 2023, we had total assets of $30.5 billion and 163 full-time employees. Our Board of Directors recognizes that human capital management is critical to our success and is actively engaged on overseeing it.

The leadership development and compensation committee is actively involved in reviewing and evaluating the Company’s programs and practices related to leadership development and human capital management, including reviewing succession plans relating to positions held by executive officers and making recommendations to the Board regarding the selection of individuals to fill these positions. In the most recent review of our succession planning in November 2023, all the independent directors participated.

Annually, our Chief Executive Officer and Executive Chairman report to the leadership development and compensation committee on succession planning for other senior executive positions. Our Board of Directors also maintains an emergency Chief Executive Officer succession plan which will become effective in the event our Chief Executive Officer becomes unable to perform his duties in order to minimize potential disruption to our business and operations.